AI Prompt Cheat Sheets for Smart Family Budgeting in Singapore

Last updated: 11 February 2026

Written by: Circles.Life

6 minutes read

Managing family finances in Singapore’s high-cost environment can be overwhelming. Between housing, groceries, education, and family activities, expenses add up fast. Traditional budgeting methods like manual spreadsheets often take time and effort to maintain.

That’s where AI comes in. Tools like ChatGPT and CirclesAI can simplify family budgeting by automating calculations, forecasting expenses, and identifying cost-saving opportunities. Below, you’ll find AI prompt cheat sheets that make financial planning smarter, faster, and stress-free.

Keytakeways

AI adoption continues to accelerate as user trust and real-world use cases expand.

Content creation and copywriting remain the largest AI application segment by revenue.

Recommendation systems are expected to be the fastest-growing AI application area.

Prompt engineering is emerging as a major market, with rapid long-term growth projections.

Platforms with large prompt libraries help professionals apply AI more effectively.

Access to the right tools and prompts plays a key role in maximizing AI productivity.

Understanding the 50/30/20 Rule Budgeting

Overview of the Rule

A simple way to structure your budget is by using the 50/30/20 rule:

50% of your income goes to needs (housing, food, utilities).

30% goes to wants (entertainment, dining out, travel).

20% is reserved for savings and investments.

This framework helps families manage money wisely while maintaining balance between necessities and enjoyment. You can easily tweak these percentages based on your household size and income level.

Why Use AI for Household Budget Planning?

AI tools are increasingly being used to simplify personal finance by making budgeting more efficient, flexible, and easier to manage on a day-to-day basis.

Saves time on routine budgeting and calculations

AI can automatically categorize expenses, calculate totals, and track spending patterns, reducing the time spent on manual budgeting tasks.

Creates personalized financial frameworks

By analyzing income, expenses, and goals, AI helps build budgeting frameworks tailored to individual households rather than one-size-fits-all templates.

Improves financial literacy through conversational guidance

AI explains financial concepts in simple language, allowing users to ask questions and better understand budgeting, saving, and spending decisions.

Adapts to changing financial needs

As income, expenses, or priorities change, AI tools can adjust budgets and recommendations in real time, keeping plans relevant and up to date.

Reduces financial stress and decision fatigue

By providing clear insights and suggestions, AI reduces the mental load of managing finances and helps users make confident, informed decisions.

AI Prompts for AI Powered Family Budgeting in Singapore

Tracking Income and Expenses

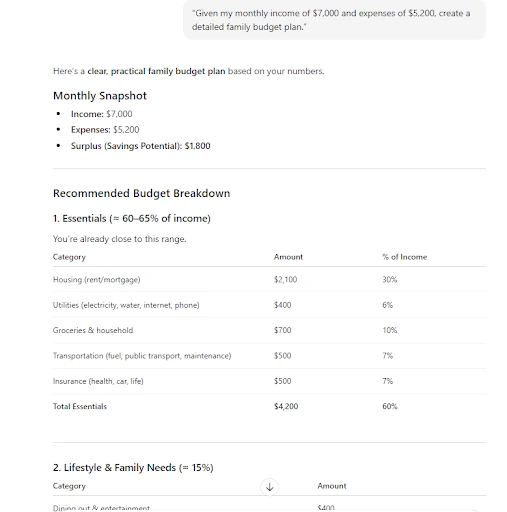

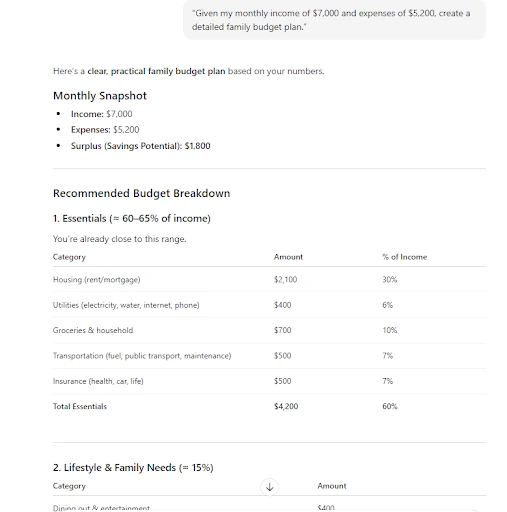

Prompt 1: “Given my monthly income of $7,000 and expenses of $5,200, create a detailed family budget plan.”

Prompt 2: “Analyze my last three months of family expenses and categorize them into needs, wants, and savings.”

Prompt 3: “Here’s a CSV file of our expenses. Create a pie chart showing our spending breakdown by category.”

Purpose: These prompts automate expense tracking and visualization, giving families a clearer view of where their money goes.

Did you know? In 2025, the global prompt-engineering market is valued at approximately $505 billion and is projected to grow to US $6.5 trillion by 2034, according to Precedence Research.

Forecasting Future Expenses

Prompt 4: “Based on current spending patterns, predict my family’s expenses for the next six months.”

Prompt 5: “Identify months where our family spending might exceed our budget and suggest adjustments.”

Purpose: ChatGPT can forecast financial trends, helping families plan ahead for school fees, holidays, or festive spending.

Did you know? With more than 2 million users and access to over 4,500 public prompts, AIPRM enables professionals to use AI more effectively across a wide range of applications.

Identifying Savings Opportunities

Prompt 6: “Review my family’s current spending habits and suggest areas to cut costs without affecting essentials.”

Prompt 7: “Recommend ways to save on recurring bills like utilities, groceries, and subscriptions for a family of four.”

Prompt 8: “Create a list of cost-effective meal plans for the family within a $500 monthly grocery budget.”

Prompt 9: “Suggest strategies to allocate extra income toward savings and education funds.”

Prompt 10: “Propose an investment plan based on our family’s current income and expenses.”

Purpose: These prompts uncover areas where small changes can result in long-term financial benefits.

Did you know? By application, the recommendation systems segment is expected to see the fastest growth during the forecast period.

Saving & Goal Setting

AI can help turn long-term financial goals into clear, manageable plans by breaking them down into realistic monthly actions. Instead of relying on generic formulas, AI adjusts recommendations based on your income, expenses, and timeline.

Prompt 11: Create a savings plan to build a $XX emergency fund within the next three years.

Prompt 12: Help me figure out how much I need to set aside each month for my holiday shopping this year.

Prompt 13: Suggest 5–10 creative ways I can lower my utility bills.

Prompt 14: How much do I need to save each month to buy a $XX house next year?

Prompt 15: Help me make a plan to save $5,000 for a family vacation to Italy next year.

Prompt 16: How much should I save monthly to pay $25,000 per year for my child’s college tuition in five years?

Try AI Prompting with CirclesAI for an Enhanced Experience

Introduction to CirclesAI

CirclesAI combines multiple advanced AI models such as GPT-5.2, Google Gemini, and Perplexity Sonar to deliver real-time financial insights that simplify budgeting for Singaporean families.

Features of CirclesAI

Advanced reasoning for complex financial questions.

Up-to-date trends and local market insights.

Deep data analysis for accurate predictions and recommendations.

Benefits for Users

All-in-One AI Tool: Simplifies family budgeting, forecasting, and savings planning.

Affordable Subscription: Only $12/month.

Extra Perks: Enjoy 400GB free data + 8GB roaming, perfect for families managing finances on the go.

Last updated on: October 2025

Best Circles.Life SIM-Only Plans with Lifestyle Rewards

Plan Name | Monthly Price | Data & Features | Lifestyle Benefits |

5G Core Plan | $12 (reverts to $15 after 2 months) | 500GB + Free 8GB Roaming (7 countries) + Unlimited Calls | Free AI bundle powered by GPT-5.2, Google Gemini, Perplexity Sonar + Movie tickets at $10 + Bonus $30 cashback on Circles Zerofy (T&Cs apply) |

5G Most Unrestricted Plan | $14.50 (reverts to $18 after 3 months) | 800GB + Free 12GB Roaming (7 countries) + Unlimited Calls | Free AI bundle powered by GPT-5.2, Google Gemini, Perplexity Sonar + Movie tickets at $10 + Bonus $30 cashback on Circles Zerofy (T&Cs apply) |

5G Global Plan | $30 | 1TB + Free 100GB Asia Roaming + 2GB Global roaming + Unlimited Calls | Free AI bundle powered by GPT-5.2, Google Gemini, Perplexity Sonar + Movie tickets at $10 + Bonus $30 cashback on Circles Zerofy (T&Cs apply) |

Last updated on: 26 January 2026

Conclusion

AI is reshaping how people plan, manage, and make decisions in everyday life. From budgeting and goal setting to productivity and learning, the right AI tools can save time, reduce stress, and provide clearer direction through personalized, conversational guidance. When combined with fast, reliable 5G connectivity, these tools become even more accessible and useful on the go.

CirclesAI brings this experience together by giving users access to powerful AI tools directly through their mobile plan. Instead of juggling multiple apps or subscriptions, users can plan finances, organize tasks, learn new skills, and get instant answers anytime, anywhere.

If you’re looking for a smarter way to stay connected while making the most of AI in daily life, CirclesAI offers a simple and flexible solution built into Circles.Life’s 5G SIM-only plans. It’s an easy way to turn your mobile plan into a practical, AI-powered assistant that supports your goals at home, at work, and beyond.

To help you make the most of AI in everyday life and work, we’ve built a comprehensive library of practical guides and use cases. If you’re new to prompting, start with our AI prompt guides for travel itineraries and weekend trip prompt templates, along with tips on how professionals can prompt AI more effectively. We also explore how AI assistants make life easier, boost workplace productivity, and deliver real value through business use cases, including how AI helps businesses save time and money. For better conversations with AI, check out our AI chat cheat sheet. If you’re comparing tools, our Circles AI vs GPT-5 and Circles AI vs Poe guides break down the differences clearly. Beyond productivity, we show how AI can support smarter personal finance with AI-powered family budgeting in Singapore, and simplify travel planning through cheat sheets for cheaper travel, weekend trips, 7-day holidays, and long vacation itineraries. We also offer destination-specific AI prompt guides for Bali and Thailand, helping you plan faster, smarter, and more efficiently.

Related Blogs

ChatGPT started the AI chatbot revolution, but it’s not the only option. Explore the top AI chatbots of 2026 and find the best tool for your needs.

Explore the key upgrades of ChatGPT 5 over GPT-4, including enhanced accuracy, multimodal features, and industry-specific applications.

Compare CirclesAI and Poe for AI access in Singapore. See which marketplace offers better pricing, models, and usability for everyday AI users.

Want more?

Subscribe to our newsletter and get notifications when there’s more to read!

By submitting your details, you consent to us sending you promotional and marketing updates. Please read our Privacy Policy for more information.